Payroll tax withholding calculator 2023

Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. The Tax Calculator uses tax.

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube

This calculator is integrated with a W-4 Form Tax withholding feature.

. Subtract 12900 for Married otherwise. The Calculator will ask you the following questions. The table below shows the federal General Schedule Base Payscale factoring in next-years expected 26 across-the-board.

This calculator is integrated with a W-4 Form Tax withholding feature. The maximum an employee will pay in 2022 is 911400. CNBC reported that a recent congressional proposal.

2022 Federal income tax withholding calculation. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. The Payroll Office is.

Ad Process Payroll Faster Easier With ADP Payroll. 250 minus 200 50. Sage Income Tax Calculator.

There are 3 withholding calculators you can use depending on your situation. 2022 Federal income tax withholding calculation. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. Get Started With ADP Payroll. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Prepare and e-File your. Subtract 12900 for Married otherwise. This calculator is integrated with a W-4 Form Tax withholding feature.

2020 Federal income tax withholding calculation. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Ad Payroll So Easy You Can Set It Up Run It Yourself.

In case you got any Tax Questions. Subtract 12900 for Married otherwise. 250 and subtract the refund adjust amount from that.

The standard FUTA tax rate is 6 so your. Ad Compare This Years Top 5 Free Payroll Software. 2022 Federal income tax withholding calculation.

The Tax withheld for individuals calculator is. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Get Started With ADP Payroll.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. 2022 Federal income tax withholding calculation.

For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Discover ADP Payroll Benefits Insurance Time Talent HR More. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

2023 Paid Family Leave Payroll Deduction Calculator. That result is the tax withholding amount. Nanny Tax Payroll Calculator Gtm Payroll Services.

Free Unbiased Reviews Top Picks. For employees withholding is the amount of federal income tax withheld from your paycheck. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Prepare and e-File your. In the event of a conflict between the information from the Pay Rate Calculator and.

Ad Payroll So Easy You Can Set It Up Run It Yourself. It will be updated with 2023 tax year data as soon the data is available from the IRS. Tax withheld for individuals calculator.

All Services Backed by Tax Guarantee. Ad Compare This Years Top 5 Free Payroll Software. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay.

Start the TAXstimator Then select your IRS Tax Return Filing. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Then look at your last paychecks tax withholding amount eg.

Calculates tax and salary deductions with detailed. For example based on the rates for 2022-2023 a. The maximum an employee will pay in 2022 is.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Multiply taxable gross wages by the number of pay periods per.

The calculator can help estimate Federal State Medicare and Social Security tax withholdings. The amount of income tax your employer withholds from your regular pay. Prepare and e-File your.

All Services Backed by Tax Guarantee. It will confirm the deductions you include on your. Ad Process Payroll Faster Easier With ADP Payroll.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Free Unbiased Reviews Top Picks. Choose the right calculator.

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

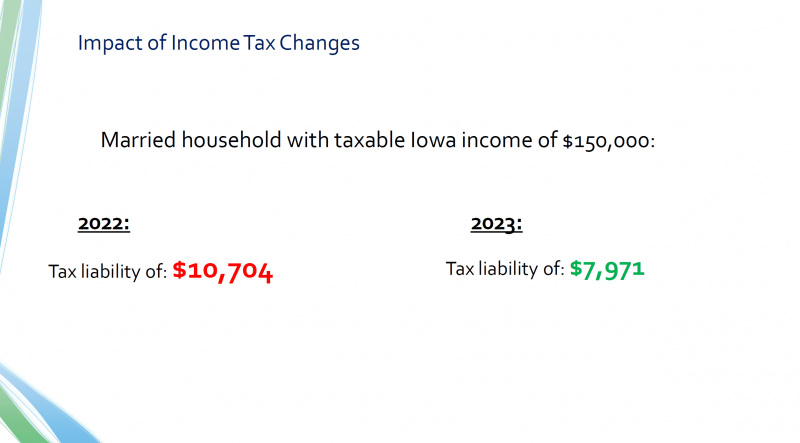

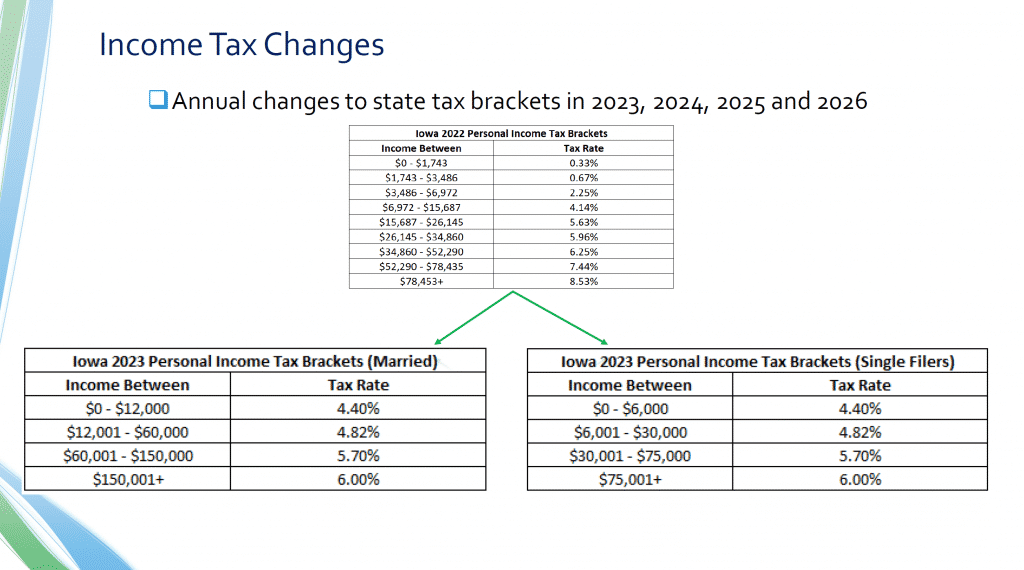

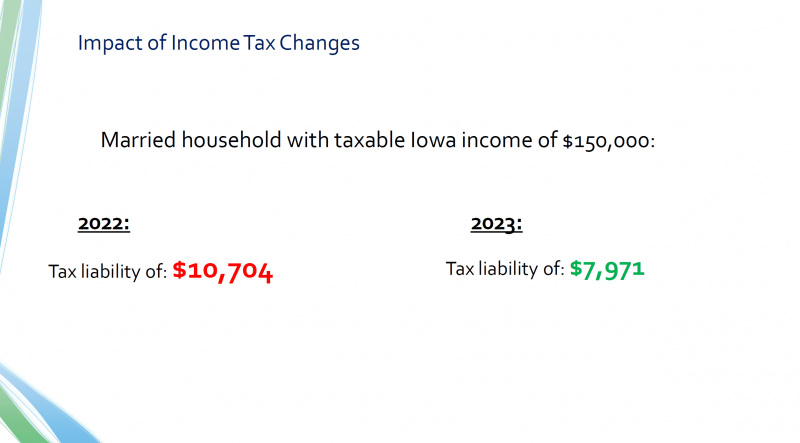

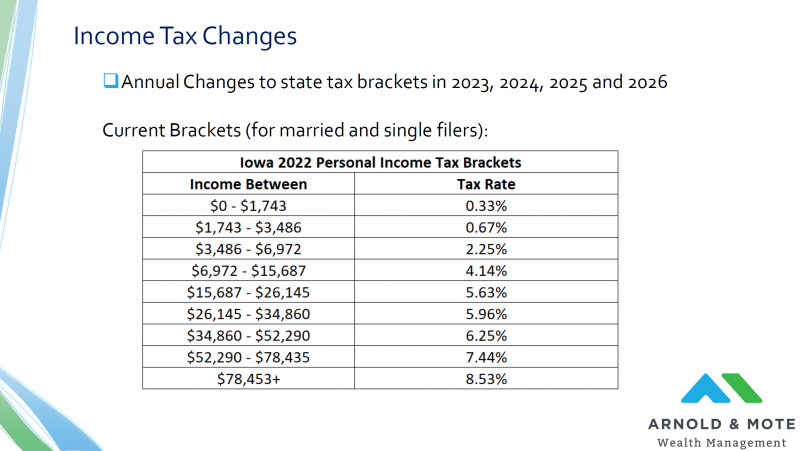

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Salary Slab Rates Budget 2022 2023 Latest Updates Youtube

Social Security What Is The Wage Base For 2023 Gobankingrates

Bitcoin Btc Price Prediction 2022 2023 2025 2030 Primexbt

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

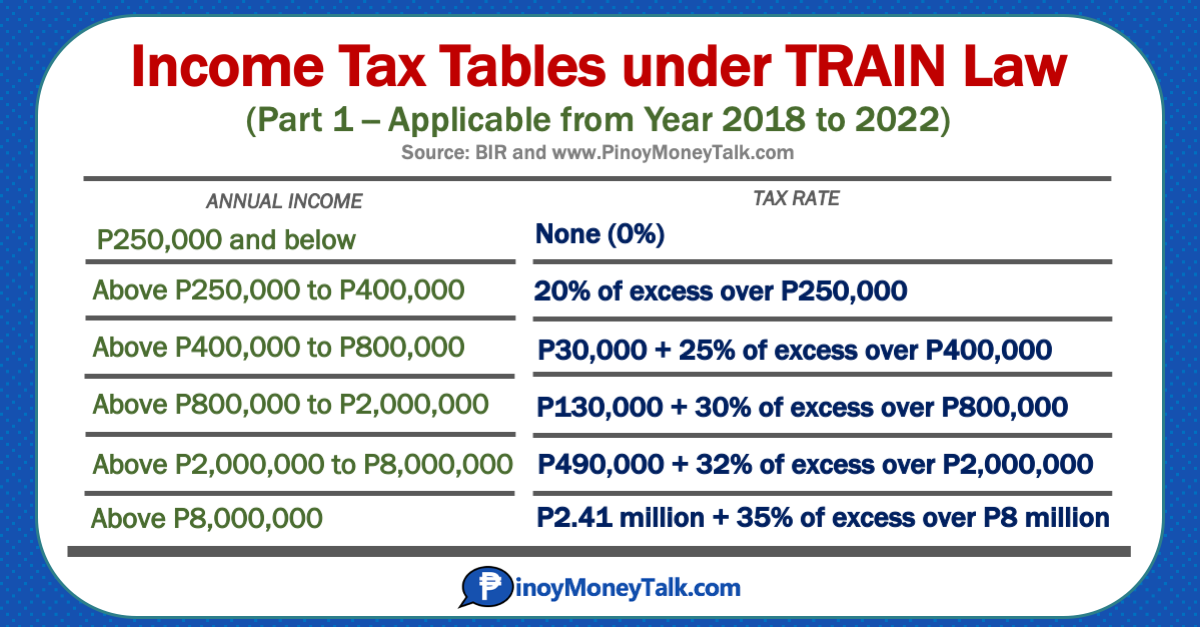

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

2022 2023 Tax Brackets Rates For Each Income Level

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube